The whispers of an impending recession are growing louder, and for good reason. A number of critical financial indicators are signaling that the economic storm may be closer than we think. In this post, we’ll look at four key warning signs: declining personal savings, rising personal consumption expenditures, increasing credit card usage, and a rise in credit card loan delinquencies at major banks. When these signs occur simultaneously, they create a clear signal that it might be time to take action. Decreasing exposure to the stock market and increasing your allocation to gold can be a smart move to safeguard your wealth during uncertain times.

Get our Free In-Depth Analysis of the Precious Metals Market PDF.

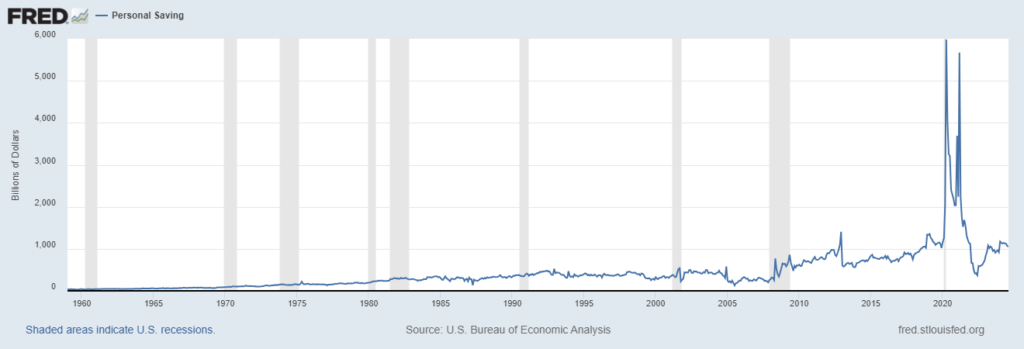

1. Personal Savings Are Declining

One of the most telling indicators of economic trouble is the decline in personal savings rates. Over the past year, many households have experienced a sharp decrease in the amount they’re able to set aside. This erosion of financial safety nets often happens as the cost of living rises faster than wages, leaving less room for saving.

Historically, declining personal savings have been a precursor to economic slowdowns. When people save less, they have less capacity to weather financial storms like job loss, unexpected expenses, or market downturns. A shrinking savings cushion can force households to take on more debt, which further weakens the foundation of consumer-driven economies. This is often the first sign that a recession is looming on the horizon.

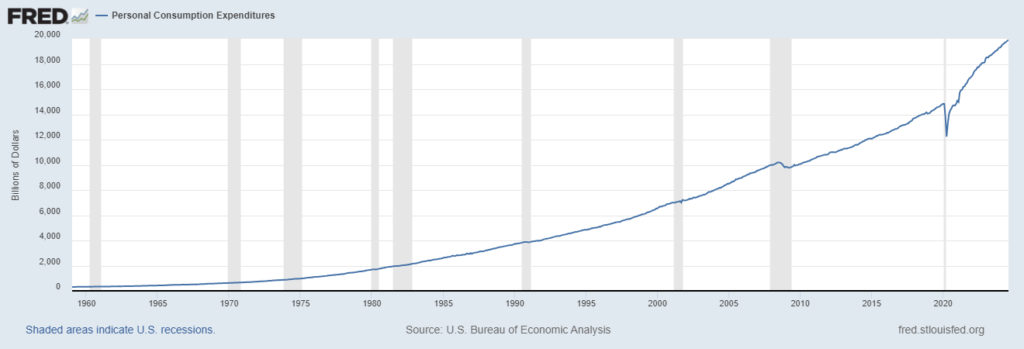

2. Personal Consumption Expenditures Are Rising

At the same time, personal consumption expenditures (PCE)—the measure of consumer spending—have been on the rise. This may seem counterintuitive. If people are saving less, why are they spending more? The answer often lies in inflation and rising prices for essential goods and services. When the costs of food, gas, and housing increase, people are forced to allocate a larger portion of their income to basic needs, leaving little room for savings.

The combination of rising consumption expenditures and declining savings is a red flag. It suggests that consumers are spending beyond their means, relying on credit, or tapping into their savings to maintain their lifestyle. This kind of behavior is unsustainable and typically leads to slower consumer spending as financial pressures increase—another hallmark of a recession.

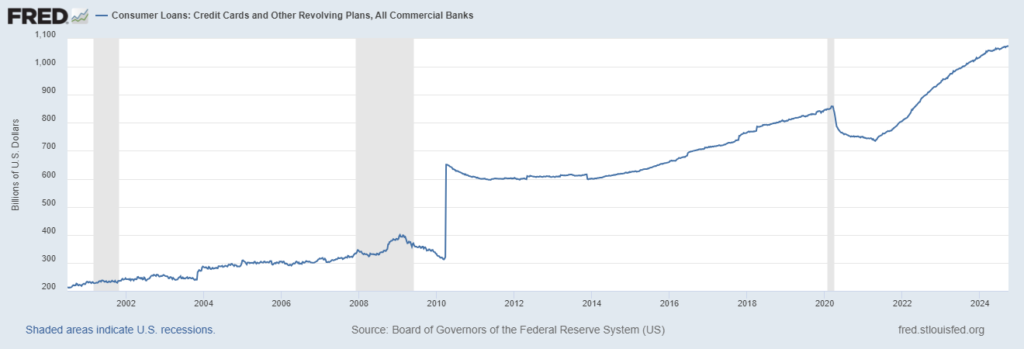

3. Credit Card Usage Is Increasing

As personal savings decline and expenses rise, more people are turning to credit cards and other forms of revolving credit to make ends meet. This increase in consumer debt signals that many are living paycheck to paycheck or using borrowed money to cover daily expenses.

According to recent data, credit card balances are rising at an alarming rate. High-interest debt burdens can quickly spiral out of control, especially if an economic downturn leads to job losses or a sharp decline in incomes. Rising consumer debt often leads to tighter credit conditions as lenders become more cautious, which can stifle economic growth. When debt levels rise faster than the economy can support, it puts additional pressure on an already fragile financial system.

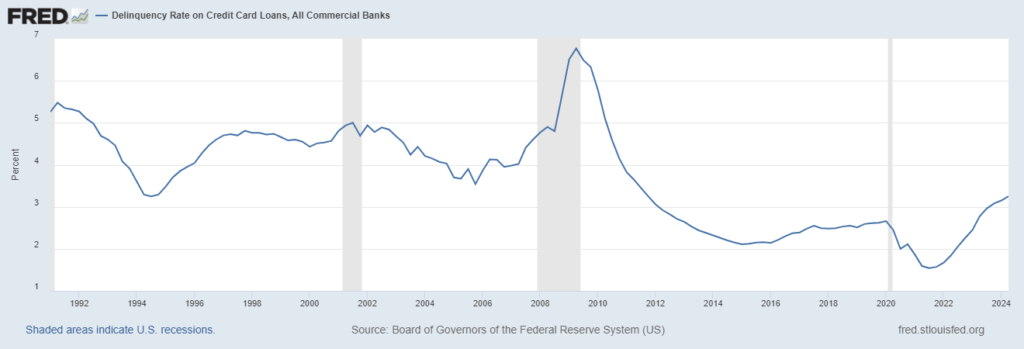

4. Delinquency Rates on Credit Card Loans Are Rising

Another troubling trend is the rising delinquency rate on credit card loans at major commercial banks. When more people start missing payments, it is often a clear sign of financial distress. This uptick in delinquency rates is a key indicator that many consumers are struggling to manage their growing debt obligations.

Delinquency rates tend to rise just before a recession, as financially strained consumers default on their loans. This creates a domino effect in the broader economy as banks tighten their lending standards, which further constrains consumer spending and business investment. Rising delinquencies are often a precursor to broader financial instability, which can lead to a full-blown recession.

All Signs Point to a Recession—How to Protect Your Wealth

When these four indicators—declining personal savings, rising personal consumption expenditures, increasing credit card debt, and rising delinquencies—occur simultaneously, they paint a troubling picture of the economy. They suggest that the average consumer is overstretched, and the system is becoming increasingly fragile.

In times like these, traditional investments such as stocks can become highly volatile. Economic downturns typically result in declining corporate profits, which can send stock prices tumbling. If you’re heavily exposed to the stock market, now may be the time to reconsider your portfolio.

One way to protect your wealth during a potential recession is by increasing your exposure to gold. Gold has historically been a safe haven during times of economic uncertainty. Unlike stocks, gold is a tangible asset with intrinsic value that doesn’t depend on corporate earnings or market sentiment. It also tends to perform well when inflation is high, or when currency values are declining, both of which are common during a recession.

As the warning signs of an economic downturn grow more apparent, now is the time to take proactive steps to protect your financial future. Reducing exposure to volatile markets and increasing investments in gold can help you preserve your wealth and weather the storm of an impending recession.

Conclusion

The simultaneous rise in personal consumption, credit card usage, and delinquencies, paired with a decline in personal savings, is a clear warning that the economy may be heading into recession territory. Now is the time to act. Decrease your stock market exposure and increase your allocation to gold, a historically reliable asset in times of economic downturn.